Nvidia is spending money faster than ever to secure its dominance in artificial intelligence. On Tuesday, the chipmaker announced a massive partnership with Microsoft to invest up to $10 billion in AI developer Anthropic. This move highlights the frantic pace of dealmaking, with Nvidia pumping nearly $24 billion into 59 companies since the start of 2025.

Data from Pitchbook shows that Nvidia has now invested roughly $53 billion across the AI landscape since 2020. The money is going everywhere, from chatbot creators like OpenAI and Cohere to cloud service providers like CoreWeave.

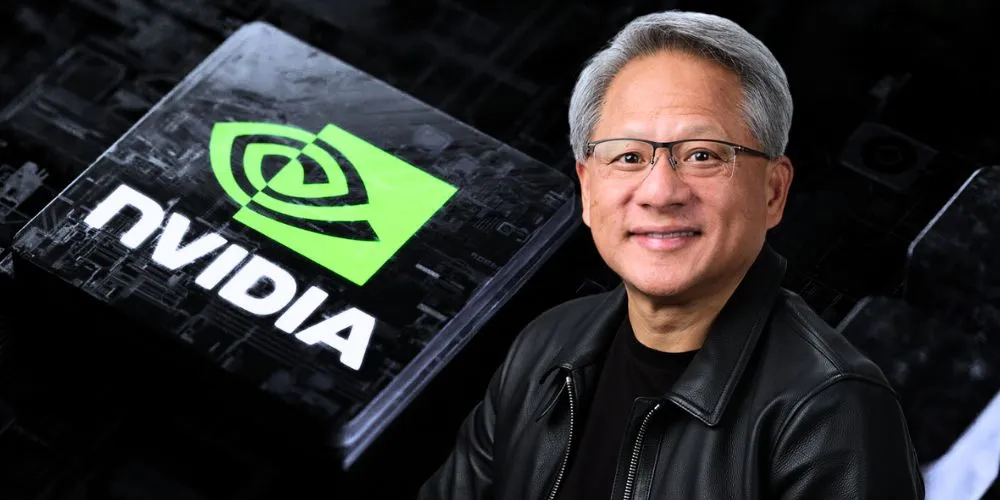

However, this aggressive strategy makes some investors nervous. Critics describe these agreements as “circular.” Essentially, Nvidia gives cash to startups, and those startups often turn around and use that capital—or the infrastructure it buys—to purchase Nvidia’s own chips. Jay Goldberg, an analyst at Seaport, calls the situation “murky.” He questions whether Nvidia is making genuine investments or simply subsidizing the demand for its own products to keep stock prices high.

The new Anthropic deal fits this pattern. While Nvidia and Microsoft put in cash, Anthropic has agreed to buy $30 billion in computing capacity from Microsoft Azure, which relies heavily on Nvidia hardware.

Nvidia CEO Jensen Huang brushes off the criticism. He insists the investments are about backing winners, not inflating revenue numbers. Speaking on a podcast recently, he argued that companies like OpenAI are destined to become trillion-dollar giants. “Who doesn’t want to be an investor in that?” Huang asked, adding that his only regret was not having enough money to invest in them years ago.

Despite skepticism from some quarters about a potential market bubble, other market watchers back Huang’s play. Bernstein analyst Stacy Rasgon argued that cementing ties with the biggest players in the tech industry is currently the best possible use of Nvidia’s cash pile.